How Credit Reports Work: Understanding Your Credit History

- Aug 22, 2024

- 4 min read

Updated: 2 days ago

Your credit report plays a crucial role in your financial life, especially when it comes to major decisions like buying a home or securing a loan. But what exactly is a credit report, and how does it affect your ability to borrow money? At Presidential Bank Mortgage, we believe that understanding your credit report is key to managing your finances effectively. Here’s a breakdown of how credit reports work and what you need to know.

What Is a Credit Report?

A credit report is a detailed record of your credit history, compiled by credit bureaus such as Equifax, Experian, and TransUnion. It contains information about your borrowing and repayment habits, and it’s used by lenders, landlords, and even some employers to assess your financial reliability.

Your credit report typically includes:

Personal Information: This includes your name, Social Security number, birthdate, address, and employment history. This information helps verify your identity but does not affect your credit score.

Credit Accounts: Also known as trade lines, this section lists your credit accounts, including credit cards, mortgages, auto loans, and other lines of credit. For each account, you’ll see details such as the creditor’s name, the account type, the date it was opened, your credit limit or loan amount, and your payment history.

Credit Inquiries: When you apply for credit, the lender checks your credit report, creating an inquiry. There are two types: hard inquiries (which can affect your credit score) and soft inquiries (which do not).

Public Records: This section includes any bankruptcies, foreclosures, tax liens, or civil judgments against you. These can significantly impact your credit score.

Collections: If you’ve fallen behind on payments and the debt has been sent to a collection agency, it will appear in this section. Collections can remain on your report for up to seven years.

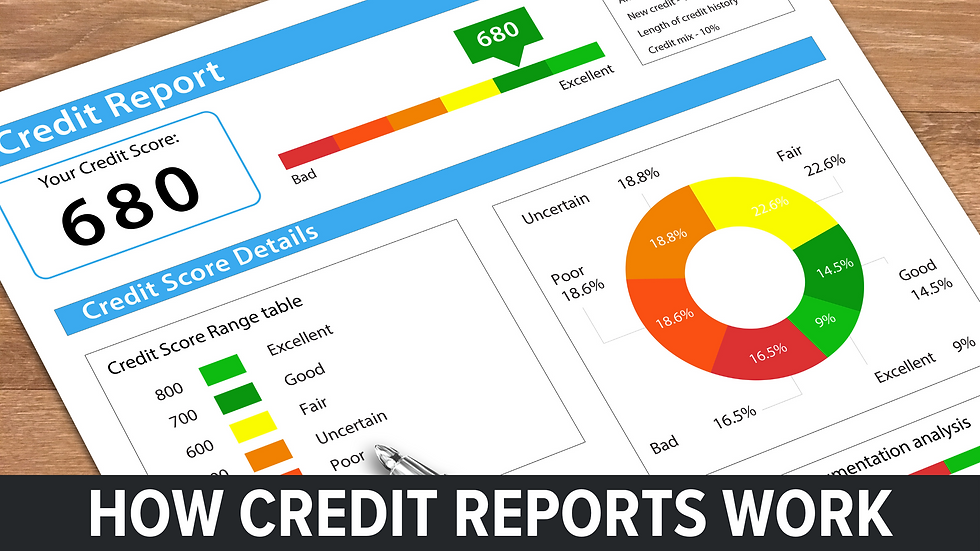

How Is Your Credit Score Calculated?

While your credit report contains detailed information about your credit history, your credit score is a three-digit number that summarizes your creditworthiness. The most commonly used credit score is the FICO score, which ranges from 300 to 850. Here’s how it’s calculated:

Payment History (35%): Your track record of making on-time payments is the most significant factor in your credit score. Late payments, defaults, and accounts sent to collections can negatively impact your score.

Amounts Owed (30%): This factor considers the total amount of debt you owe, including how much of your available credit you’re using. High credit card balances relative to your credit limits can lower your score.

Length of Credit History (15%): The longer you’ve had credit accounts, the more positively it can impact your score. This factor considers the age of your oldest account, your newest account, and the average age of all your accounts.

Credit Mix (10%): Having a diverse mix of credit accounts (such as credit cards, installment loans, and mortgages) can slightly boost your score, as it shows you can manage different types of credit.

New Credit (10%): Opening multiple new credit accounts in a short period can lower your score, as it may indicate financial instability.

Why Your Credit Report Matters

Your credit report and score are vital for several reasons:

Loan Approval: Lenders use your credit report to determine your eligibility for loans and to set your interest rates. A higher credit score typically means better loan terms.

Interest Rates: With a higher credit score, you’re likely to qualify for lower interest rates, saving you money over the life of a loan.

Employment Opportunities: Some employers review credit reports as part of the hiring process, particularly for roles involving financial responsibilities.

Rental Applications: Landlords may check your credit report to decide whether to approve your rental application.

How to Maintain a Healthy Credit Report

Maintaining a healthy credit report is crucial for your financial well-being. Here are some tips:

Pay Your Bills on Time: Late payments can significantly impact your credit score. Set up reminders or automatic payments to ensure you’re always on time.

Monitor Your Credit Report: Regularly check your credit report for errors or fraudulent activity. You’re entitled to a free credit report from each of the three major credit bureaus once a year at AnnualCreditReport.com.

Keep Credit Card Balances Low: Aim to use less than 30% of your available credit to maintain a healthy credit score.

Avoid Opening Too Many New Accounts: Each new account creates a hard inquiry, which can lower your credit score temporarily.

Build a Long Credit History: Keep older accounts open to benefit from a longer credit history, which positively affects your score.

Understanding how credit reports work is essential for managing your financial health and making informed decisions. Whether you’re planning to buy a home, apply for a loan, or simply want to improve your credit score, knowing what’s in your credit report can help you take control of your financial future.

At Presidential Bank Mortgage, we’re here to help you navigate the complexities of credit and mortgage financing. If you have questions about your credit or need guidance on improving your score, contact us today!